The basis for the assessment is our Omni-Shopper study, which we conducted in cooperation with the EHI Retail Institute. We examined the customer journey of the three sectors Consumer Electronics, Food Retail and Pharmacies by means of customer surveys and analysed the current shopper needs in detail. We were also able to evaluate the tools used at the point-of-sale as well as conduct an evaluation of their success or potential in a differentiated manner.

POS tools and the three steps to a purchase decision.

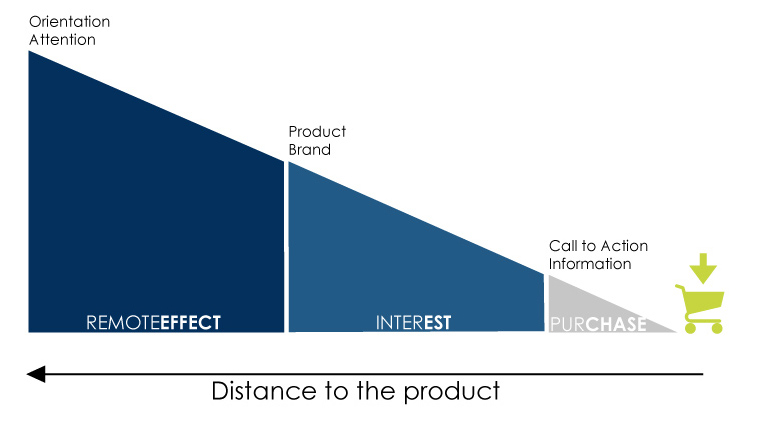

All tools that are used at the POS should contribute to sales, brand building and the image of a product. But before that can happen, the top priority is to attract attention.

In order for this to succeed, the customer consciously or unconsciously goes through a process of three steps, which fulfil different tasks depending on the distance to the product.

The design of the individual steps follows a simple principle: the further away the customer is from the product, the more eye-catching and visible the placement must be in order to attract the shopper’s attention.

Classification of the tools at the point of sale – according to the effect.

Following on from this, any tool used at the POS can be classified in this system.

The more systematically I plan the implementation of tools at the POS according to their effect, the more targeted this leads to success. Each tool has a primary task (from the remote effect to the purchase decision), but can fulfil all tasks depending on its design. And in the end, only one thing counts: sales.

In the following, I rank several tools in relation to their primary effect in the system:

In addition to well-known and proven tools for influencing purchase decisions at the POS, digitalisation also regularly results in new or digital variants of proven tools. Whether interactive operator displays for more information and reservations or virtual reality tools for eventful shopping, these tools can also be classified easily. Each tool should always be analysed in detail, the effect assessed and a target-oriented selection made.

What works where?

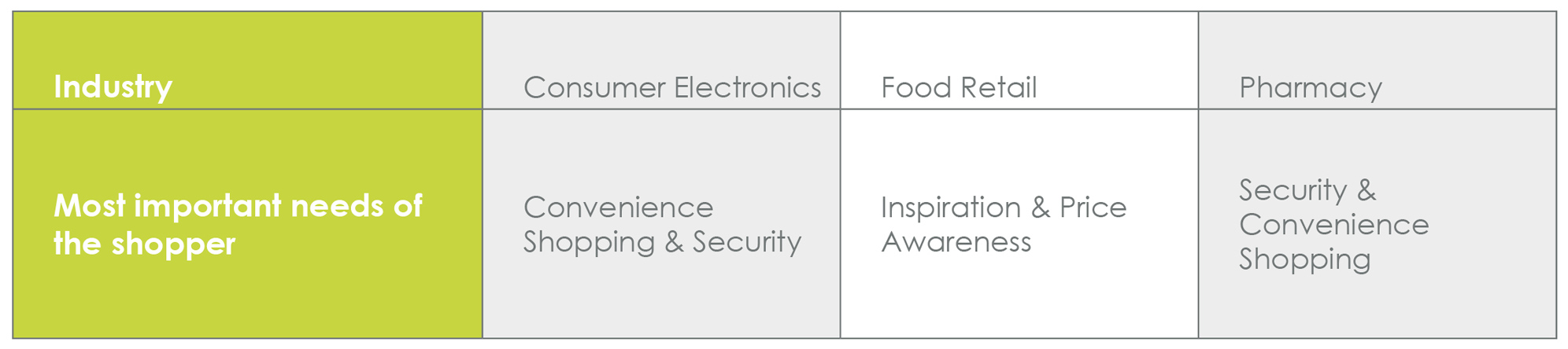

If we now take a look at our Omni-Shopper study together with the EHI Retail Institute and the STEIN system, we will come to another important conclusion about the selection of the POS tool that fits the intended purpose. It is also important to consider the industry, as it also determines the strongest shopper need.

In our study, four basic needs were identified across three sectors (CE, Retail, Pharmacy), which are drivers in the purchasing and decision-making process: Inspiration, security, price awareness and convenience shopping. The general finding was that the shopper is always one and the same person shopping in different industries. Only the product category decides how strong which need is particularly important in each industry.

The STEIN system, together with the right selection of suitable POS tools, leads to the greatest success if the shopper’s strongest need is met in the three stages.

Industry & most important shopper needs

These needs are also reflected in the results of our shopper survey:

Lebensmittel Zeitung summarises the latest aspects and developments in food retailing in its “POS Marketing Report”. The result: the POS is becoming emotional and digital, whereby the difference between young and old is immense and can only be addressed with a differentiated concept in the salesroom. In total, the report provides 7 insights about the shopper:

- The loyalty to the shopping venue is at a constantly high level.

- Clean markets with a good offer (especially for fresh products) and a favourable price-performance ratio promote loyalty.

- The checkout zone is an obstacle for younger shoppers and a feel-good place for older ones. Customers are annoyed by long waiting times at the checkout.

- The number of market visits is decreasing, but the discipline with which shopping planning is “processed” is increasing.

- Digital helpers are becoming more important in purchasing planning.

- Awareness and readiness for use of digital services at the POS are increasing.

- “Hard selling” is the trump card for in-store marketing measures.

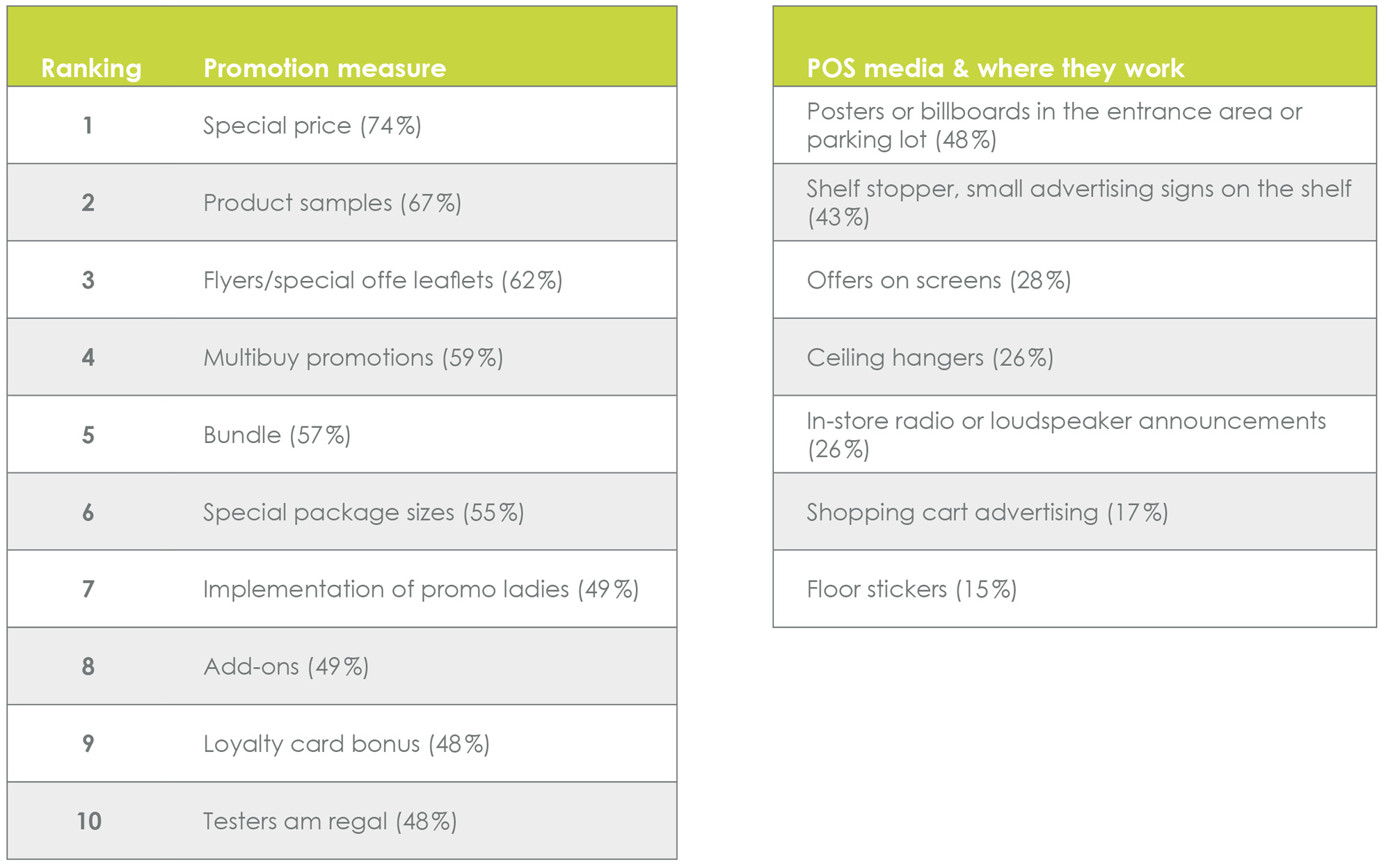

In the POS marketing report, promotion measures and POS media were examined specifically for the retail trade and classified after approval by the respondents.

Conclusion

Each tool at the POS fulfils its very own task, but also works in conjunction with other tools. The primary aim of the remote effect is to attract the shopper’s attention. The closer I am to the product, the more information I can and must provide the shopper with about the product.

If we look at the system as a whole, there are three factors that are decisive in the selection of the right POS tool for my POS concept: the desired effect, the predominant shopper need and the respective industry, i.e. the product type.

The potential lies in digitalisation, which converts or at least complements familiar POS tools into a digital form, such as monitors instead of posters, newsletters instead of flyers or digital displays on shelves instead of paper signs. It increases the retailer’s influence on the content, but the needs and impact remain unchanged.