Knowledge of the market and POS competence are needed to face the challenge.

The growing importance of gaming.

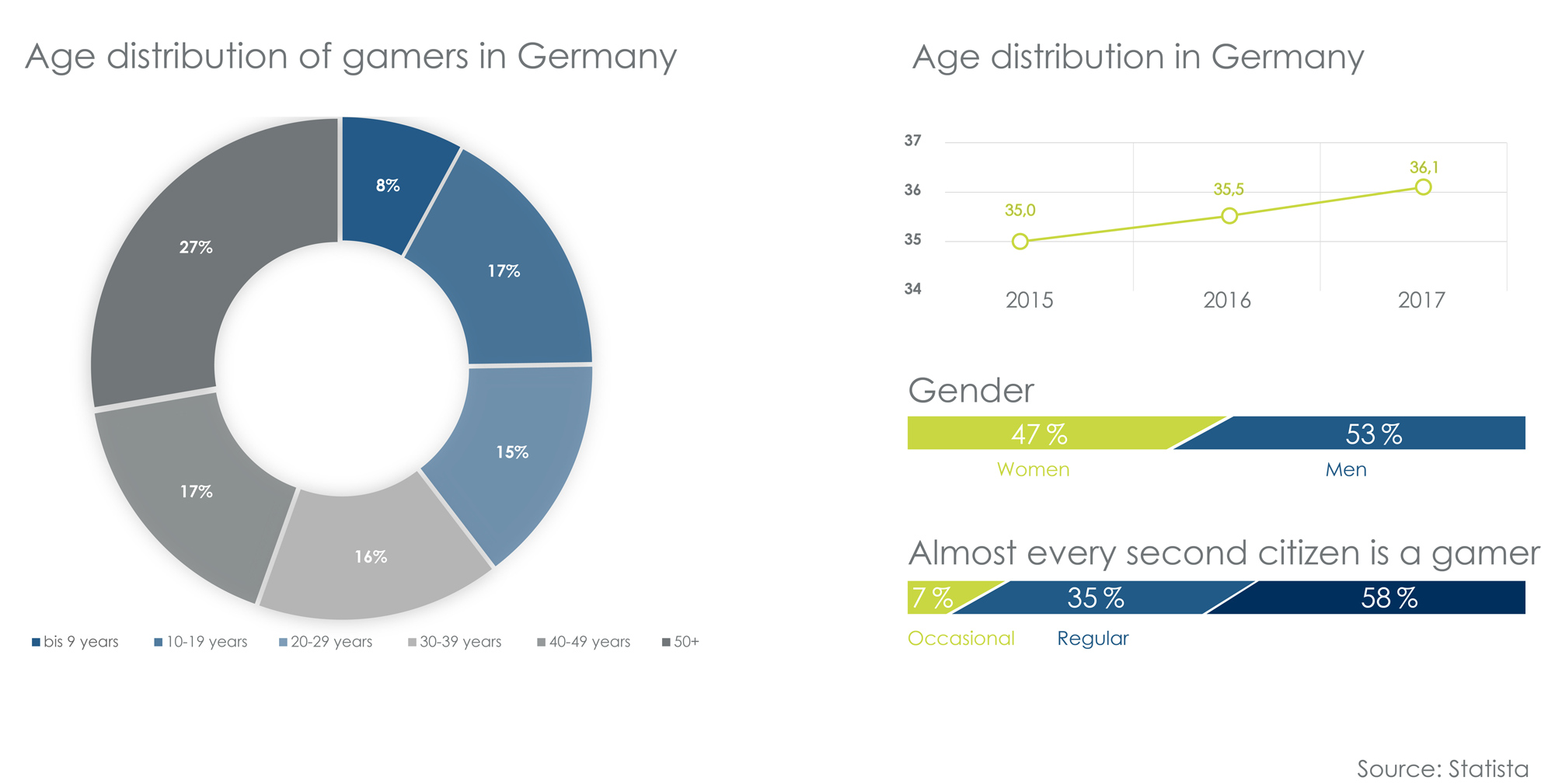

The gaming market has been in transition and growing for several years. More than 40% of Germans play computer and video games. Gaming has become more popular in recent years. It has broken free of the niche and has arrived in the mass market. Acceptance and the support base has grown steadily across all age groups. It can be observed that the average age is rising, the diversity is increasing and the standard is higher. The segment thus offers attractive sales potential for manufacturers and retailers. For us as POS experts, this is reason enough to take a closer look at this market.

The gaming market.

When I say “out of the niche,” in numbers, this means: In Germany, sales in the gaming sector including hardware amounted to 3.35 billion Euros in 2017 (a growth of 15% compared to the previous year). Of this, hardware accounted for almost 1 billion Euros in sales, and video games, apps and fees accounted for approximately 2.3 billion euros. As for the relation: the turnover of the entire consumer electronics industry in Germany in 2018 amounts to approx. 26.8 billion Euros.

18 million gamers are male and 16.3 million are female. In the age group 14-29 years, over 70% play. The average age of gamers is currently 36.1 years (2018). The largest proportion are so-called “silver gamers”, i.e. those over 50 years of age. 35% of Germans play regularly and 7% play occasionally.

In Germany, games are played as video, PC and online games:

- on the PlayStation (sales of the PS4 in 2017: 1.31 million),

on the Xbox (sales of the Xbox ONE in 2017: 263 thousand) or

on the Wii (sales of Wii U in 2017: 5.1 thousand) - as online and browser games

(revenue with fees in 2017: 166 million Euros / Revenue with additional virtual content for video games in 2017: 844 million Euros) - as apps for smartphones & tablets (sales in 2017: 497 million Euros)

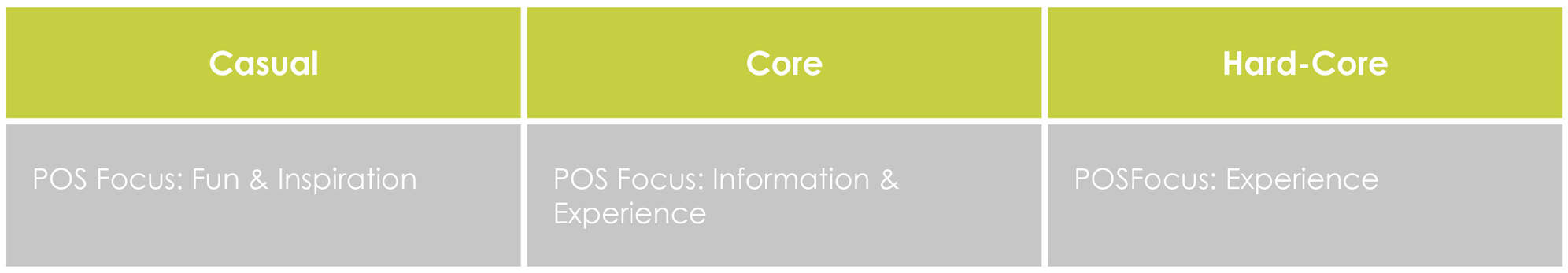

The gamer types:

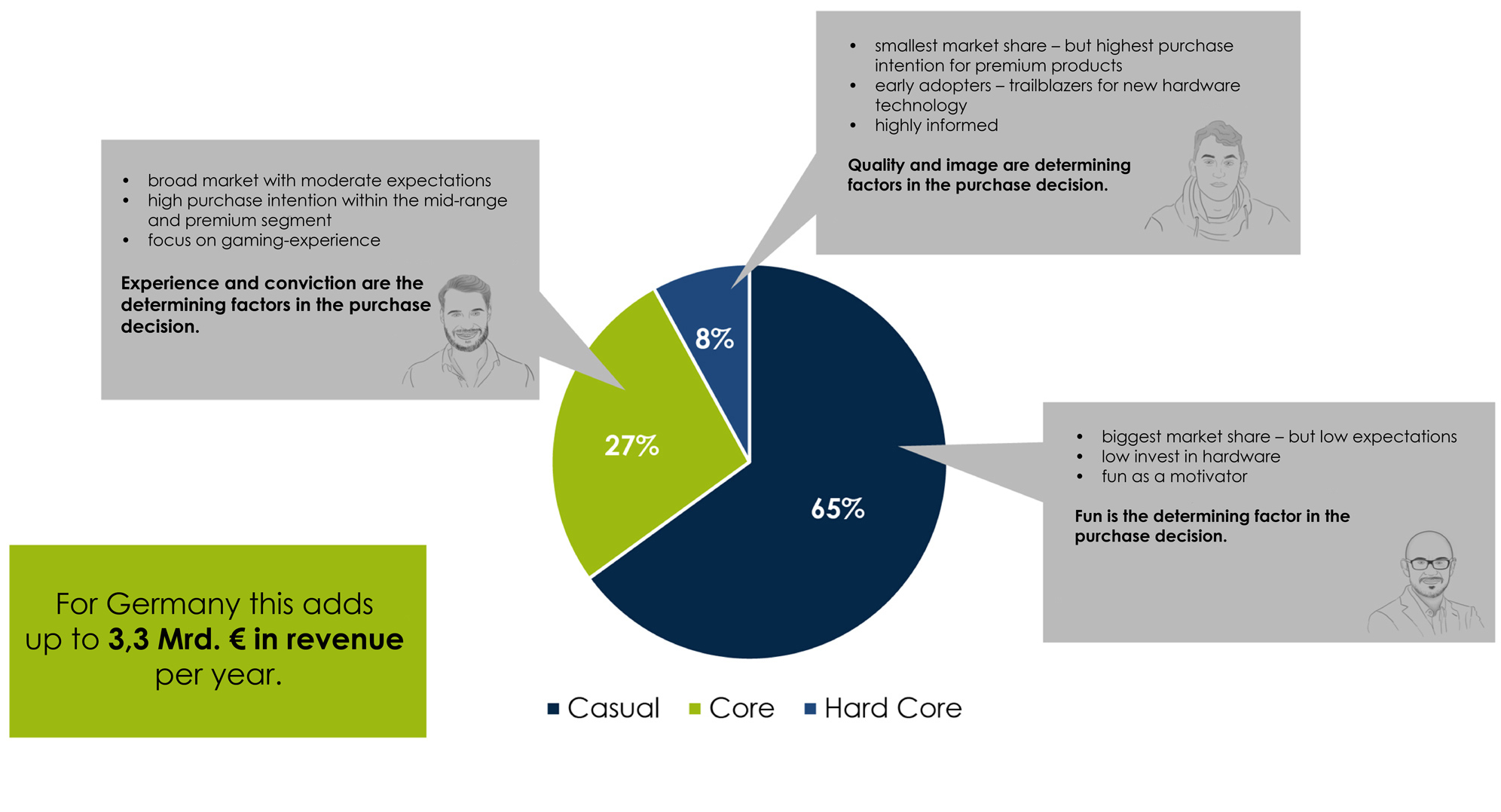

We have divided the gamers into three groups. The focus was on criteria of needs, preferences, buying behaviour, willingness to invest and gaming behaviour.

Gamer-type: Casual

The mainstream gamer who plays up to 5 hours a week for relaxation with easy games on various devices at a low investment level.

Gamer-type: Core

The regular, more demanding gamer spends up to 15 hours a week playing mainstream games, not always on the latest devices.

Gamer-type: Hard-Core

The professional gamer mainly plays hard core games on a PC & laptop and invests at least 15 hours a week in gaming. The demand and thus the willingness to invest for the best performance is very high.

The top 3 most popular game varieties are:

- Action Games / Ego shooters

- Adventure games

- Skill games

The challenge for manufacturers and retailers.

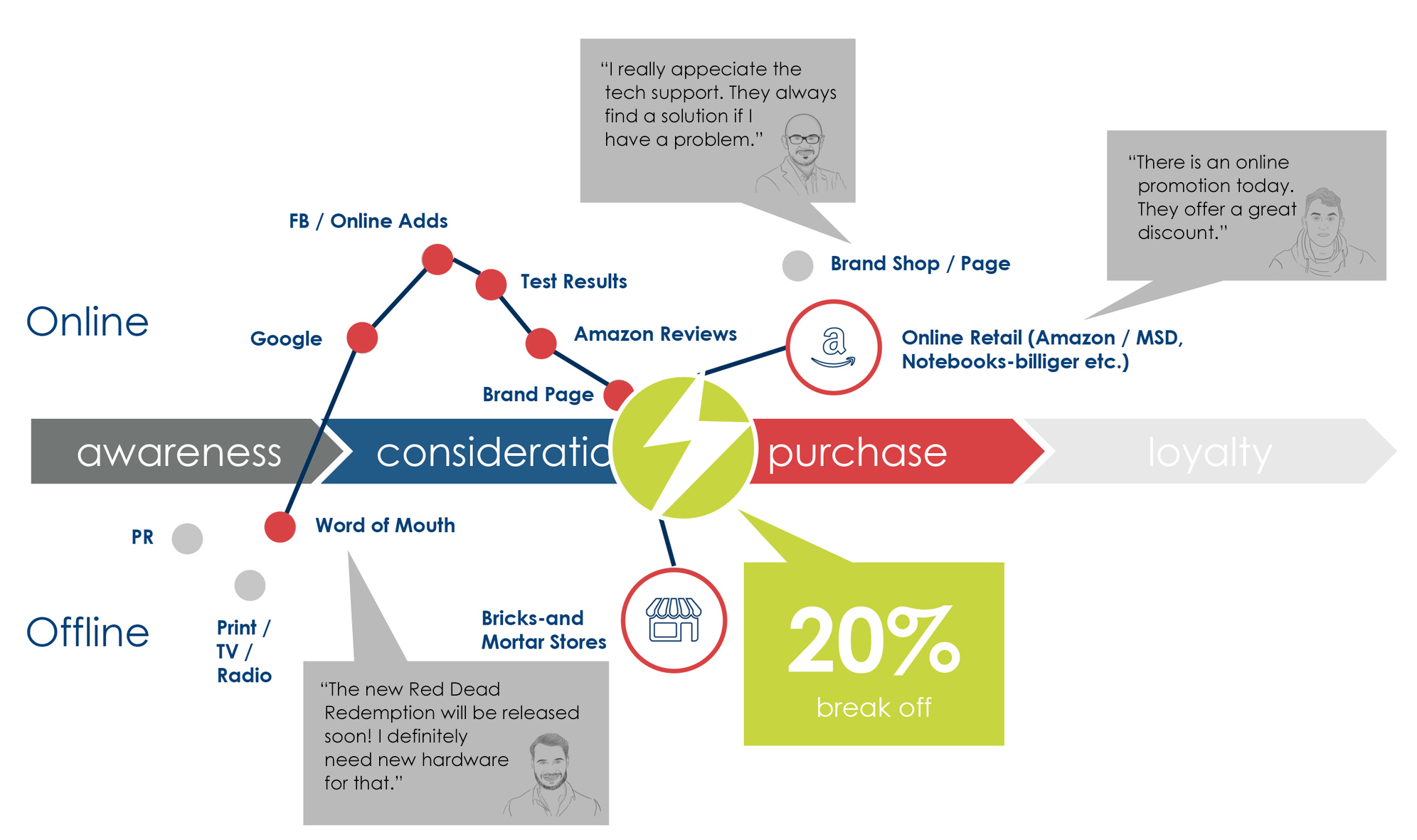

The growing gaming market offers both manufacturers and retailers many opportunities to develop into sparring partners for gamers in the course of their Customer Journey with a high level of technical and consulting competence. The attractiveness and the fun of gaming are strongly linked to the correct equipment. To properly tap into this target group, I see three big questions for retailers and manufacturers, the answers to which are crucial for success at the point of sale.

- Who are the “Gamer Shoppers” and what is important to them?

- What inspiration can the POS provide?

- What can a 360° concept look like at the POS?

Approaches on how to proceed

Here, the focus is also on offering an exciting shopping experience that not only allows the gamers to try out the games, but also integrates an entertainment factor, competent advice, upselling & cross-selling options as well as useful services to enhance customer loyalty.

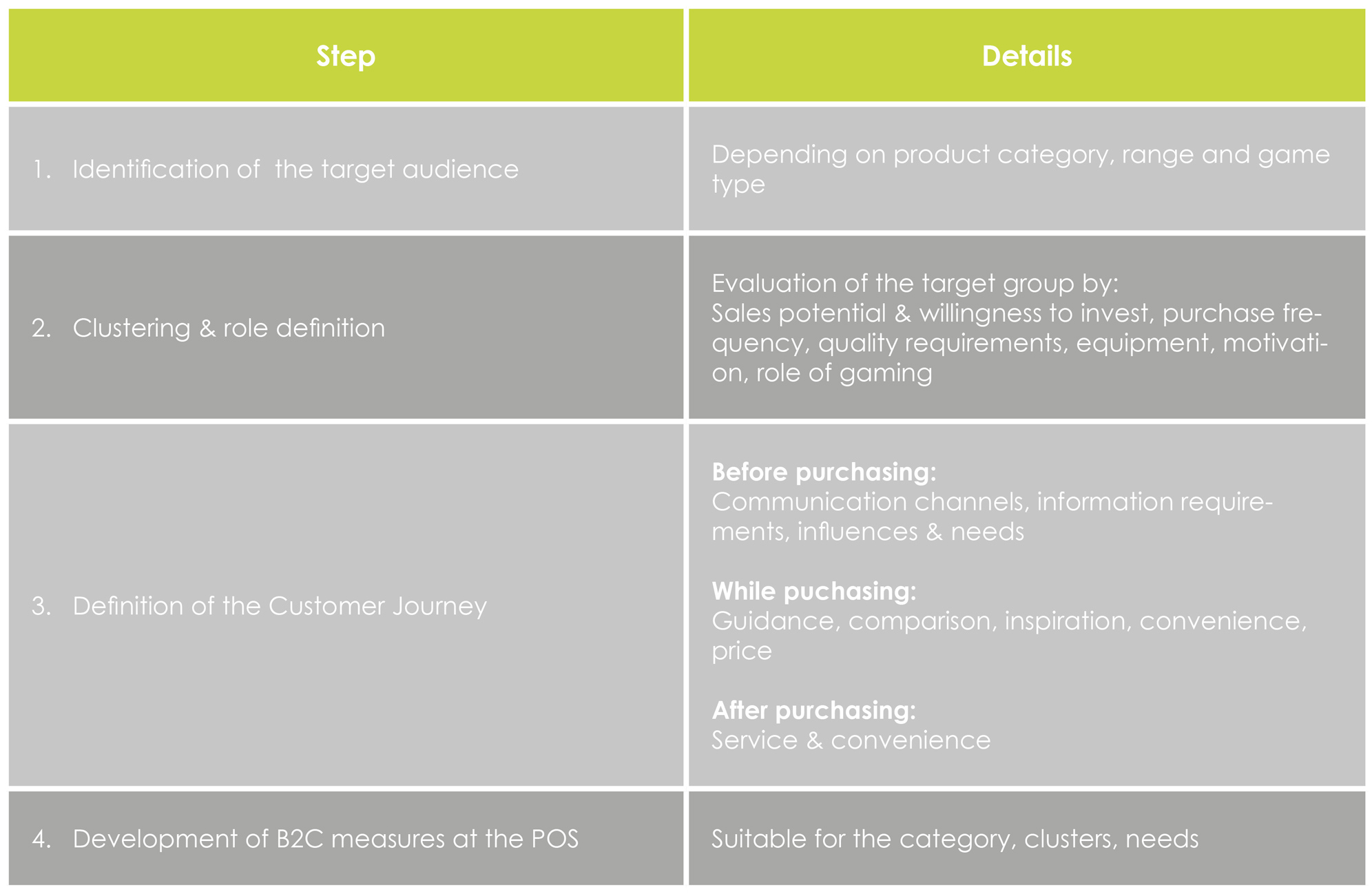

We have developed a suitable 360° concept for the POS with four steps:

The Gaming Customer Journey

Only those who know the needs can develop the appropriate measures at the POS. As described, clustering of the target group provides the basis. In general, we divide gamers into three types and develop specific measures for each one, but all of them are addressed at the same touchpoints.

My conclusion

Gaming is a future market with growing popularity across all age groups. The target group will therefore become larger and more diverse over the next few years – and yet it remains loyal. The importance of gaming is increasing for manufacturers and retailers but compared to the previous stakeholders at the POS, gamers are also challenging those involved with special interests and special requirements. We know the answer on how to inspire gamers at the POS and offer them a real shopping experience.

STEIN has been a POS expert in the field of consumer electronics for decades. We advise, design and implement effective concepts and measures derived from the customer objectives and based on our experience.