Or how retailers and industry can benefit from increased collaboration.

We have been operating in hundreds of locations for manufacturers of the most diverse articles every single day for four decades. Thanks to our experience and an intensive analysis, we have taken the new developments on board and have created solutions for the Point of Sale. Observing with a vigilant eye, the situation in the stationary retail trade has become increasingly tough. In the food retail trade, for example, there were 330 branches* per 1 million people in 2014. And Germany is far ahead of other European countries. In light of the growing online trade – also in food retail – the need to establish a distinctive image is increasing for retailers. At the same time, this presents an opportunity for industry and retail trade to work together. This is the only way that stationary retail still has a realistic chance in the future.

Category growth vs. brand growth

For many years, the brand was at the centre of all trade. But when not only brands, but also the retailers are fiercely competing against each other, a distinctive differentiation at each store location is all the more important. How can this be achieved? With a clear focus on the category instead of on the individual brand and a closer collaboration between the retailer and the industry.

The retailer is the expert on site. He knows his shoppers incl. demographic facts and their needs. He analyses the shopping cart, the situation and the environment and as a result, can optimally align the set-up and the appearance of the market as well as the product portfolio with these factors.

At the moment, the industry still tends to focus on temporarily supporting a product or product line but also concentrates on the correct permanent placement in the respective market. In addition, the industry has extensive knowledge about the product category due to market research and competitive analysis. We can and should make use of this.

In my opinion, the current distribution of tasks is not the solution. The industry’s seasonal or isolated focus on one brand or product only leads to a temporary shift / redistribution of sales or market share. However, this doesn’t lead to additional revenue in the retailer’s cash register, as the total cost of items in the shopping cart will not increase. If, on the other hand, the category grows, so does everybody’s sales turnover.

The category is the key to a win-win situation

In my view, concentrating on the category – with a clear focus on raising the image of each individual retailer – instead of on individual brands has enormous potential for increasing sales and volume for the retailer as well as the industry. However, this requires a change in thinking and the option of taking the specific circumstances of each retailer into consideration.

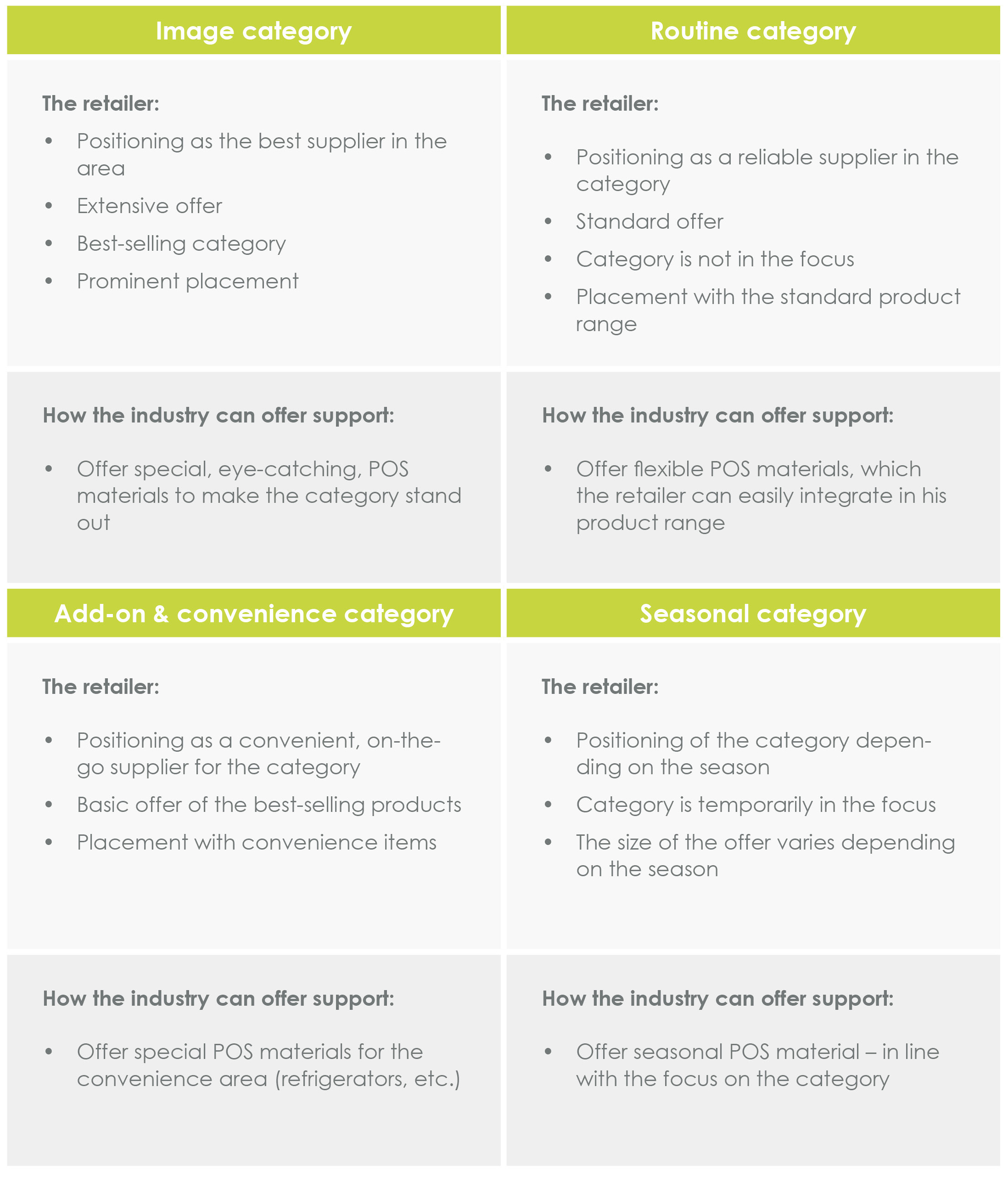

The retailer should be able to individually decide which category to focus on based on the customer insights that he has. Generally, four areas can help determine which category to focus on: image, routine, convenience or season.

Let us imagine four retailers that each follow a different approach regarding the category of Craft beer:

Retailer 1: Image

He offers the customer a well-positioned, broad range of Craft Beer and provides guidance within the category. He places great emphasis on the placement of the category.

Retailer 2: Routine

Although he offers Craft Beer, he doesn’t focus on it. He only offers the most common varieties and doesn’t position them elaborately.

Retailer 3: Convenience

He mainly offers Craft Beer as a convenience product. His focus is on individual, cooled bottles, which the customer can take along for immediate consumption on the go. He needs a placement that, for example, focuses on the presentation in the refrigerator.

Retailer 4: Season

He mainly offers Craft Beer in a seasonal capacity. For example, in the summertime for barbeques or for holidays like Father’s Day. So he only needs elaborate placements for special occasions or seasons.

Instead of giving the largest market the biggest activation promotion, each market should receive a package aligned with its product range and the needs of its socio-demographic environment. In order to achieve this and to support the retailers in optimally developing their categories, the industry needs new concepts that meet the various needs of the retailers and offer them suitable options.

Side note: Who is my shopper and which category should the focus be on?

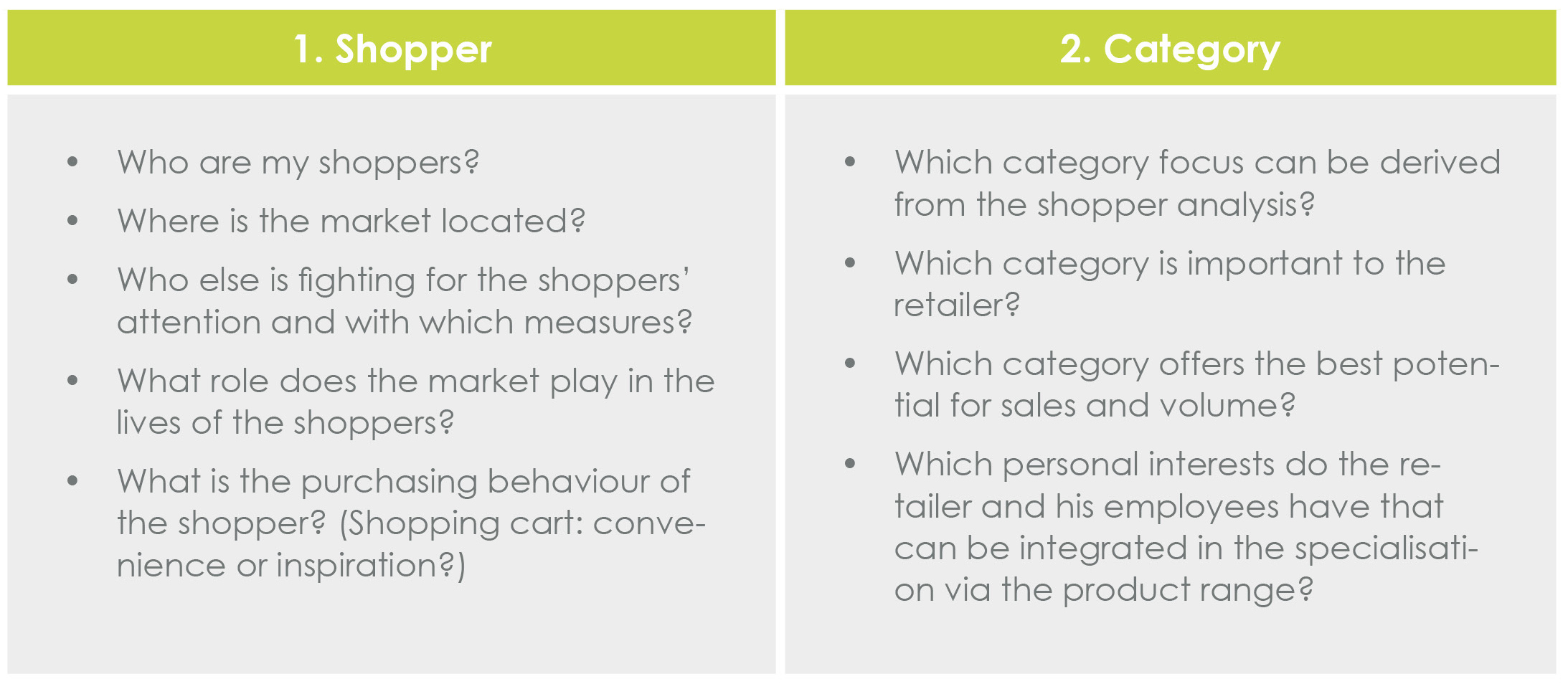

To decide which category to focus on, we came up with some questions about the shopper. Together with additional analyses, this allows the retailer to make an informed decision regarding the category.

Aligning the measures with the retailer

Generally, there are four areas that provide orientation for the focus on a specific category:

My conclusion:

In my experience, an individual focus on the growth of the category requires one thing in particular: a dialogue between the retailer and the industry. Only those who understand the needs of the other can respond adequately. In order to achieve successful growth, the industry must offer the retailer sales-promoting measures that suit the featured product lines. Scale the measures according to size (large, medium, small) depending on the varying focus on the respective categories and the design of the retail partners (Rewe, Edeka, etc.).

At the moment, the sales departments usually act according to the principle: large market, large package of measures – small market, small package. Rethinking is required, what we need are sales-promoting packages that meet the needs of the retailers.

With an individual package of measures, the sales force can improve the placement together with the retailer and ensure a growth in sales and volume across the range of categories.

* Statista, Anzahl der Filialen im Lebensmitteleinzelhandel pro 1 Million Einwohner in Europa nach Ländern im Jahr 2014